The number of people reaching 100 years of age will quadruple over the next three decades, according to the US Census Bureau. That could be a blessing or a curse, depending on how you look at it—but it highlights a sobering reality that most Americans will face in retirement: their own longevity.

According to a new study from the Nationwide Retirement Institute, most Americans say they don’t expect—or even want to—join the “Century Club” by living to be 100 years old. Regardless, many will face a retirement that could last two or three decades. When you consider the decline of pension plans offering guaranteed income and the uncertain future of Social Security and other government entitlement programs, one thing is clear: Tens of millions of people will live to advanced ages without a plan in place to ensure their money will last.

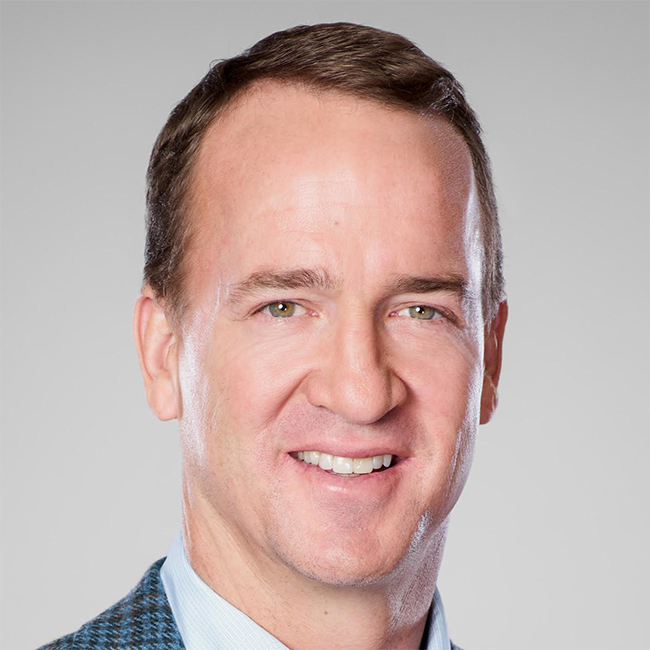

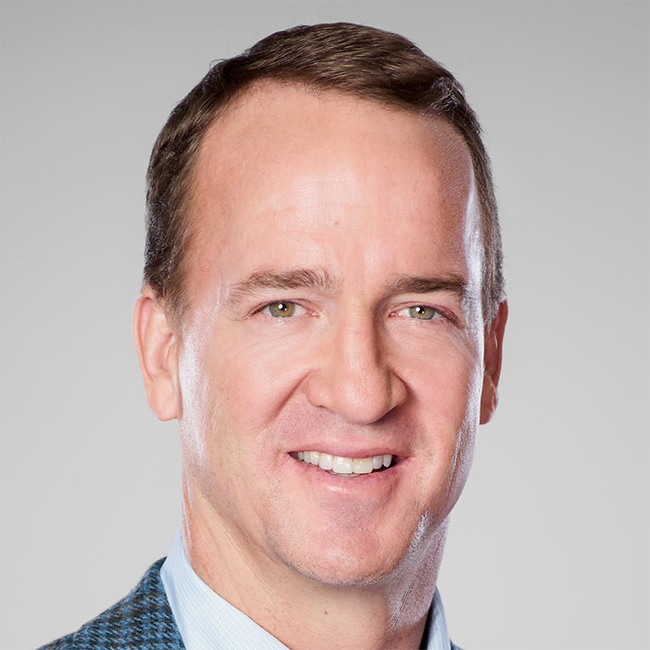

As I was considering this challenge, I thought of someone whose career—and relatively recent retirement—many of us followed. If you watched any NFL games this past season, you probably noticed how Peyton Manning continues to prove that he is so much more than just a Hall of Fame quarterback. I asked him about the steps he took to find success in the second act of his career, in hopes of gaining inspiration for helping those facing uncertainty in their retirement journey. Here’s what he shared:

“While athletes may face retirement from their first career earlier than many other people do, they face the same questions about what they are going to do next and what they can do that will utilize their strengths and tap into their interests. Figuring out that second chapter and preparing for it is critical.

I knew I couldn’t figure this out alone, so I turned to people I trust to chart a course, including my family, friends, financial professionals, coaches, and former teammates who had previously retired.

You need to have a willingness to ask questions and be 'coached.' I’ve found that asking questions and planning for every possible scenario, even those that are unlikely, has always served me well. I try to surround myself with people who are smarter than me so I can ask questions and learn from them.”

As I reflect on Peyton’s thoughts, my takeaway is that the same thing that made him good at football has set him up for success in his post-football life—a willingness to be coached.

While most Americans’ retirement plans will look different than Peyton Manning’s, they will need the same thing he did to achieve financial security—good coaching. That’s where the financial services industry and our partners in government can bridge this gap by creating innovative new products, solutions, resources, and public policy, as well as finding ways to make trusted financial advice more accessible for savers of all income levels.

In our study, seven in 10 respondents told us they believe American society is not prepared to support people with very long lifespans. I wish I could say I disagree, but the good news is it’s not too late to change that.

You need to have a willingness to ask questions and be 'coached' for a successful retirement.

Our industry offers some unique financial solutions today to help retirement savers address the longevity challenge. I’m particularly excited to see more employers offering protected retirement solutions that help employees convert their retirement savings into lifetime income. However, we need to continue working to raise plan sponsor and participant awareness of these new and innovative solutions. We also always encourage people to meet with a financial professional, which is more cost-effective than many realize. We also need to find new ways to make advice from trusted financial professionals more accessible.

That’s why events like the Milken Institute Global Conference, which brings together the top minds in financial services, present a tremendous opportunity to create urgency around the need to develop innovative new private- and public-sector strategies to address the longevity challenge before it’s too late. This call to action is about more than just growing our businesses. It’s about living up to our responsibility to help more Americans prepare for—and live longer than they may expect in—a secure, dignified retirement.