Over the past several years, I’ve had the opportunity to hear from our customers, employees, and financial advisors around the world about the unique challenges and opportunities they face at work, at home, and in their communities.

From Rio to Tokyo and to my own hometown in Delaware, there is one common issue: People are living longer, but they aren’t prepared for a commensurately longer retirement.

Over the last century, global average life expectancy has doubled while fertility rates have broadly declined. In 1950, there were 12 working-age individuals supporting each retired person. Today, that number has dwindled to 6.4, and by 2050, it is projected to be only 2.5. Younger workers and their children will carry the burden of supporting these aging populations, as both taxpayers and caregivers.

The financial strain of longevity is compounded by the demise of state and company-backed pension schemes—once the foundation for a secure retirement—which have been replaced by defined contribution plans, like 401(k)s.

In an era of uncertainty, retirement doesn’t have to be an unknown.

These accumulation tools are a powerful vehicle towards achieving a secure retirement. But they are insufficient in addressing the vast range of needs faced by retirees around the world at a time when governments are stepping back.

In the US, a Prudential survey of 55-year-olds—the generation entering the critical final decade before retirement—found that two-thirds of Americans expect to outlive their savings, and a quarter expect to depend on financial support from their children, including living assistance, after retiring. In Japan, a “lost generation” of workers who entered the downtrodden labor market of the 1990s and 2000s and fell behind in saving for retirement are struggling to catch up.

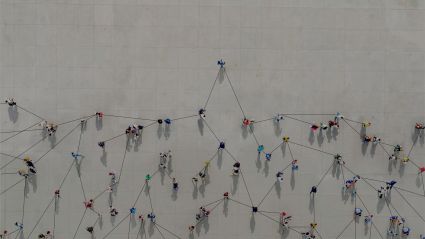

These dynamics present a profound opportunity for businesses, employers, and governments to come together in ways that create a new, sustainable model for retirement security around the world.

There are three ways we can address this global opportunity.

Closing the ‘Advice Gap’

Retirement planning is confusing at best, putting the onus on workers to become fluent in the intricate language of market risk, asset allocation, and inflation. It’s also deeply personal and cultural, depending on where you live and how you choose to spend your retirement. This complexity underscores the importance of accessible and personalized financial advice. Digital solutions and technological advances like AI tools and pension dashboards can help narrow the advice gap, but human insight and trusted connection are essential to help people navigate their individual retirement situation.

Industry Evolution

Our industry must also innovate new ways of working together and with employers, financial intermediaries, and technology companies to create the retirement products and solutions of the future. This includes structured decumulation products, such as annuities, which guarantee a retiree’s income for life and help them avoid depleting their retirement nest egg—a real risk for many retirees in an era of rising longevity.

Effective Public Policy

Finally, we must recognize that a challenge of this magnitude can only be resolved if governments and private enterprises work together. Collaboration between government and industry has yielded meaningful progress in recent years. This includes legislation promoting automatic enrollment in defined contribution plans, such as the SECURE 2.0 Act in the United States and Resolution CNPC 60/24 in Brazil, which are driving increased plan participation. But more policies like these, including ones that support and incentivize guaranteed lifetime income solutions and savings tools, are needed to move the needle further.

In an era of uncertainty, retirement doesn’t have to be an unknown. We have an opportunity to make it tangible and accessible for people around the world, for today and tomorrow.