The inventor Charles Kettering famously said, “Our imagination is the only limit to what we can hope to have in the future.” His words still reflect the spirit of innovation, but in today’s marketplace, it is also important to think about how to secure financing to bring new ideas to life.

Trade tariffs and market volatility are currently challenging the economic outlook. But even beyond the economic uncertainties, there has been a growing gap between those requiring stable, flexible capital and those who can provide it.

An essential component of a flourishing life is individual access to employment opportunities with companies that have access to the capital they need to implement their growth strategies. Businesses need diverse funding solutions that work across sectors at any point in the economic cycle to achieve a flourishing future. Those solutions should include maintaining access to healthy public markets, facilitated by the banks’ capital markets divisions, as well as increasingly popular private credit solutions– direct lending to public or private companies—to ensure companies can continue to unlock their growth potential.

A healthy economy requires robust capital markets that can cater to many situations. Companies may need diverse sources of financing in their own growth cycle.

While public markets continue to be a reliable and deep pool of capital, some businesses may need more customized solutions. That is where private credit comes in.

Imagination—not access to capital—should be the only limit to a flourishing future for all businesses.

Demand for more flexible and stable funding has been building, and by 2023, the private credit market was valued at about $1.7 trillion—a tenfold increase since 2009. Growth is expected to continue to be robust. BlackRock expects private debt as an asset class will grow to $3.5 trillion by 2028.

As remarkable as private market growth has been, it hasn’t come at the expense of public debt markets, which tripled in size to $81 trillion between 2018 and 2024. Indeed, a flourishing future for all companies is not facilitated by either private or public markets; it requires both. The parallel growth of public and private markets has been critical to ensuring companies with diverse needs can raise capital for strategic initiatives in virtually any market condition and seek optimal structures that fit their particular needs.

Banks can serve an important role in public and private credit markets. Private market solutions should be seen as complementary to bank lending rather than a replacement. Companies in need of growth capital often appreciate the customized funding solutions enabled by private credit, as well as the confidence in execution that comes with a long-term relationship with lenders. In addition, private credit can help to diversify funding for companies and reduce reliance on sources of capital that may only offer one-size-fits-all solutions.

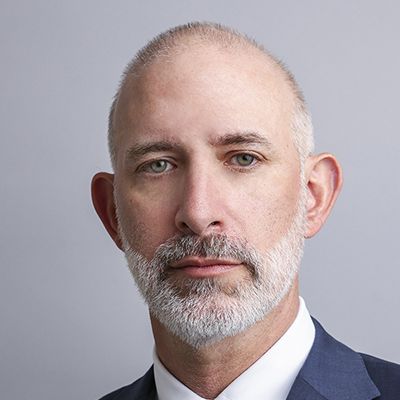

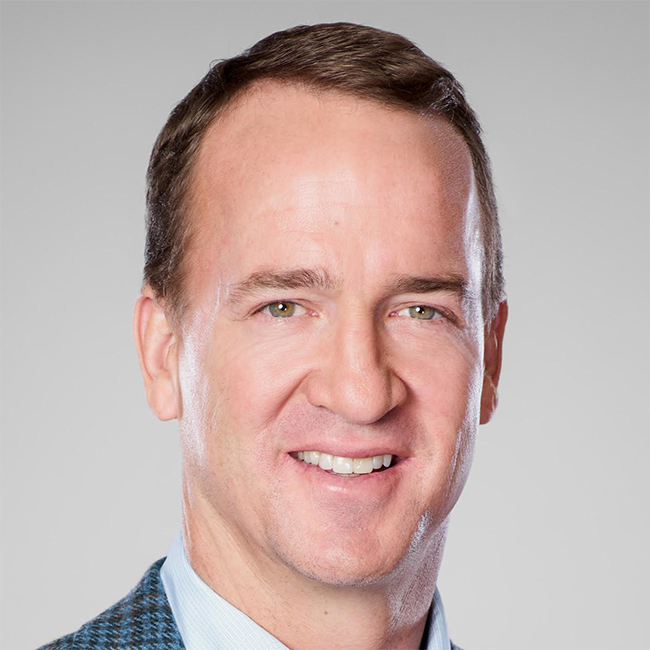

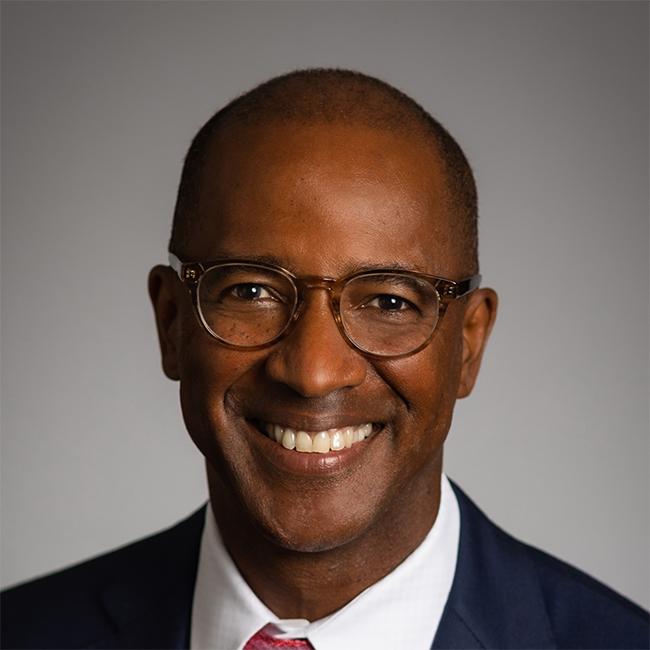

At BMO, our innovative and groundbreaking partnerships across the private credit spectrum and our ability to structure and underwrite syndicated deals provide our clients with a unique solution set that few other banks match.

We also play a vital role in connecting middle-market companies with private markets. To serve this growing segment, BMO has amassed pools of potential investors it can match to opportunities as they arise. Of course, there is more to a well-functioning private credit market than playing matchmaker; it is about understanding those businesses and connecting them with stakeholders who have a genuine interest in supporting a company’s long-term success.

One of the ways we help investors gain conviction around opportunities is by providing information on private companies that is not readily available, including evidence of how these businesses are growing and the challenges they may face.

To meet the needs of the upper middle market, which is increasingly reliant on private credit lending, we have created partnerships with leading asset management partners, such as Canal Road Group and Oak Hill.

By bridging BMO's banking, capital markets, and sponsor finance platforms with these expanded resources and capabilities, it is our aim for clients to have an array of financing solutions tailored to support their evolving needs and strategic objectives. In the face of economic uncertainty, financial markets—both private and public—continue to be drivers of long-term growth and innovation. After all, imagination—not access to capital—should be the only limit to a flourishing future for all businesses.