Sharply rising interest rates, a slowing economy, and tighter lending conditions are leaving many highly leveraged borrowers straining to service their debts. Here, we discuss the challenges facing public and private credit markets and why we see attractive value in opportunistic corporate credit strategies.

Surging Corporate Credit Markets in for a Struggle?

Corporate debt, particularly in the United States, has soared, fueled by a decade of low interest rates. US corporate debt-to-GDP exceeds levels reached before the global financial crisis (GFC) in 2008. This excess has been most noticeable in senior corporate loans: The market for these floating-rate instruments—which are purchased by public and private institutional debt funds—has tripled since before the GFC to nearly $3 trillion, according to Leveraged Commentary and Data.

With elevated debt levels, sharply rising interest rates leave many borrowers struggling to meet higher debt-service costs at the same time the slowing economy squeezes profitability. As a result, PIMCO’s base case view is that cumulative three-year default rates for these loans across public and private markets could reach 10–15 percent over the next several years, which translates into at least $300 billion of potential distressed opportunities.

We believe private loans will be a growing source of stress—and opportunities.

Private Loans Pose Both Risks and Opportunities

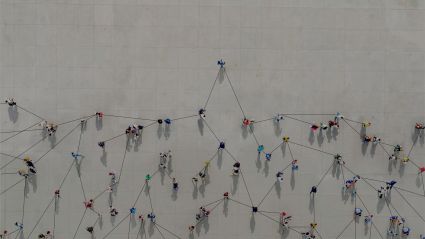

The private segment of the market has grown rapidly since the GFC—when large commercial banks stepped away from lending to small and midsize companies—and now rivals the public loan market in annual issuance.

We believe private loans will be a growing source of stress—and opportunities. These borrowers are more vulnerable to economic downturns: Many are smaller companies that have narrow business strategies, less-resourced management teams, high leverage relative to assets, and little access to the broader capital markets. As the Federal Reserve raises interest rates and a recession looms, private loan borrowers face both sharply rising debt service costs and earnings headwinds.

Credit risk in these senior loans is further heightened by the issuers’ weak investor covenants. Amid the last several years’ historically low interest rates, investors poured capital into both public and private markets, leading lenders to compete and issue deals with some of the highest leverage in history—often anticipating big future cost savings—alongside weakened covenants. An increasing number of private funds are seeking to sell their underperforming credits at a significant discount to upgrade credit quality, maintain a target yield distribution to investors, and avoid a lengthy and time-consuming restructuring process. We expect this trend will accelerate as banks increasingly tighten lending standards.

PIMCO anticipates increased opportunities to either purchase these loans at a discount or refinance companies directly with more flexible capital solution structures.

A Renewed Attractiveness for Opportunistic Credit Strategies

The pullback by traditional lenders is creating very attractive opportunities for new entrants with fresh capital to demand wider lending spreads and better-structured deals with more downside risk mitigation and less reliance on leverage. Yields have climbed to enticing levels, and the risk-adjusted return profile has considerably improved from just nine months ago.

Borrowers are increasingly seeking private capital solutions transactions. These bespoke one-stop financings can provide more flexible capital to borrowers with customized terms and structures. That often means loans structured with both a cash and a “paid in kind” interest component (under which the loan amount grows in lieu of cash interest), upfront fees, and equity warrants or exit fees.

We believe demand for bespoke capital solutions will mushroom over the next several years as borrowers face increasingly acute liquidity needs and the challenged lending environment.

As a result, PIMCO sees opportunities to provide liquidity across the middle market to performing companies that face challenges funding working capital needs, closing on acquisition targets, or refinancing existing debt maturities. We think the landscape of opportunities will get more attractive with increased maturities in 2025 and 2026, and as higher-than-expected financing costs and earnings headwinds drain liquidity.

This material contains the current opinions of the author but not necessarily PIMCO, and such opinions are subject to change without notice. This material is intended for informational purposes only. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world.