Report

Bringing Housing Finance Reform over the Finish Line

Log in or create a free account to download

Full Report

The housing finance reform debate has regained momentum, as those involved aim to move towards bipartisan housing finance system legislation in 2018.

While different approaches have evolved from the discourse about potential reforms of the secondary mortgage market structure, they all address some key elements of housing finance reform that any effective legislation must embrace.

This paper assesses these key elements of reform as well as the common elements of the two predominant models that satisfy or advance these elements.

The paper suggests the following key elements of housing finance reform:

- The private sector must be the primary source of mortgage credit and bear the primary burden for credit losses.

- Private firms benefiting from access to a government backstop must be subject to strong oversight.

- A level playing field for all firms engaged in housing finance.

- Broad access for Americans to sustainable mortgage credit on competitive terms.

- New mechanisms to support affordable housing.

Log in or create a free account to download

Full Report

Related Content

-

Twelve Things You Need to Know About the Housing Market

It was six years ago this week that the Federal Housing Finance Agency placed Fannie Mae and Freddie Mac into conservatorships. Since then, the US housing system has made significant progress, yet critical challenges and much work remain...Read Report -

Staying Power: The Effects of Short-Term Rentals on California’s Tourism Economy and Housing Affordability

Short-term rentals (STRs) are critical to regional economies, offering unique and affordable experiences to visitors, generating significant tax revenue to support local governments, and providing hosts significant income. In some places...Read Report11 11 11Alissa Dubetz, Matt Horton, and Charlotte Kesteven -

Milken Institute Housing Finance experts call on the PLS industry to self-regulate in order to qualify for loan forbearance

The PLS industry must self-regulate, says Center for Financial Markets WASHINGTON – May 6, 2020 – Eric Kaplan, director of the Milken Institute Center for Financial Market's Housing Finance Program is sounding the alarm on the private-label...Read Article -

Testimony: U.S. House of Representatives Committee on Financial Services Subcommittee Housing and Insurance: “Sustainable Housing Finance, Part III”

Ted Tozer, Senior Fellow in the Housing Finance Program at the Milken Institute Center for Financial Markets, presents in his written testimony before the U.S. House of Representatives Committee on Financial Services Subcommittee Housing...Read Report -

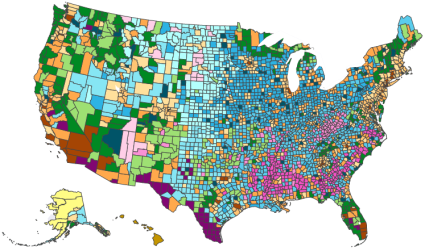

The Community Explorer: Using County-Level Data on US Diversity Effectively to Inform Policy

Diversity awareness is becoming an essential element of many policy efforts, from access to health care and financial inclusion to initiatives addressing systemic racism and inequities. Yet most of these discussions and initiatives overlook...Read Report11 11 Claude Lopez, Hyeongyul Roh, and Maggie Switek, PhD

Claude Lopez, Hyeongyul Roh, and Maggie Switek, PhD -

Provo-Orem, Utah Tops Milken Institute’s 2021 Ranking of Best-Performing Cities

California’s San Francisco and San Jose—in the top five last year—dropped to Tier 2 due to high housing costs and short-term job loss; Idaho Falls, Idaho, is No. 1 among small US cities. Los Angeles – Feb. 17, 2021 – Provo-Orem, Utah has...Read ArticleImage

Kevin Klowden

Executive Director, Milken Institute FinanceKevin Klowden is the executive director of Milken Institute Finance. He specializes in the study of key factors that underlie the development of competitive regional economies (clusters of innovation, patterns of trade and investment, and concentration of skilled labor) and how these are influenced by public policy and, in turn, affect regional economies both globally and nationally. -

Why Housing Reform Still Matters

Eight years after the mortgage meltdown, America’s housing system remains broken, serving neither taxpayers nor homeowners properly. Ed DeMarco and Michael Bright have released the first in a four-part series of papers designed to help...Read Report11 11 11Eric Kaplan, Michael Bright, and Ed DeMarco -

Austin, Texas and Idaho Falls, Idaho Top Milken Institute’s 2024 Annual Ranking of Best-Performing Cities

LOS ANGELES, CA (February 6, 2024) — Austin, Texas has demonstrated the best performance among large cities, according to the 2024 Milken Institute Best-Performing Cities (BPC) Index, taking the top spot after an impressive three-year run...Read ArticleImage

Paul Guequierre

Director, Strategic CommunicationsPaul Guequierre is the director of strategic communications. In this role, he works to increase the profile of Milken Institute in the media, raise the visibility of issues important to the organization and its stakeholders, and expand the Institute's digital presence. -

The Milken Institute’s Community Explorer Tool Offers New, In-Depth County-Level Demographic, Socio-Economic Data to Help Inform Policy Development

WASHINGTON, DC (October 18, 2022) — The Milken Institute announced the release of its Community Explorer, an interactive tool that drills down into various demographic and socio-economic data to help inform policy discussions around housing...Read ArticleImage

Chad Clinton

Director, Media RelationsChad Clinton is the director of media relations for the Milken Institute. Hired to this role in August 2021, Clinton develops and executes strategies to amplify the Institute’s core messages by generating coverage of its pillar workstreams, experts, and events. -

Legislative Approaches to Housing Finance Reform

By the standards of the contemporary American political system, proposals to reform the U.S. housing finance system moved relatively far through the legislative process in 2013 and 2014, with different bills receiving positive votes in...Read Report11 11David Scharfstein and Phillip Swagel -

Milken Institute Advisory Council Roundtable on Preventative Health

DOWNLOAD REPORT Each year, the United Kingdom National Health Service (NHS) treats more patients for preventable diseases, yet funding remains largely focused on hospital care rather than prevention. Without new investment in preventative...Read Report 11

11

11

11

-

A Blueprint for Administrative Reform of the Housing Finance System

This paper sets out proposed administrative actions to reform the housing finance system in the absence of legislation. The goal is to build upon the progress that has been made toward a safer and more effective housing finance system with...Read Report11 11 11 11Eric Kaplan, Michael Stegman, Phillip Swagel, and Theodore Tozer