Effective financial planning requires clarity about individual circumstances and an appreciation of the shifting longevity landscape. In the US, life expectancy at birth is approximately 79 years, according to the National Center for Health Statistics. But for those who survive to older age, more years are in store. Today’s average 65-year-old can expect to live 20 more years, and many significantly outlive that.

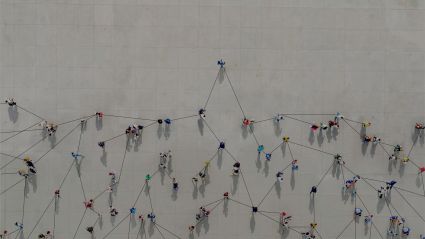

As more people live longer, a critical problem becomes clearer—too many are financially unprepared for their longer lives.

With the evolving trends in longevity, the inherent flaws of individual estate and retirement planning based on population averages are obvious and very problematic. Planning tools that analyze predictable outcomes based on the experience of large populations are widely used but fail to take into account individual characteristics and needs and are, therefore, inadequate.

It is a risky strategy to plan only for necessary retirement finances up to an ‘average’ life expectancy.

The typical inputs to generic financial planning tools include:

-

Gender

-

Genetics/DNA

-

Smoking/alcohol/lifestyle habits

-

Weight

-

Exercise habits

-

Career/occupation

-

Available medical data to detect compromised health conditions

-

Quality of medical care (which generally also has to do with geography and affluence)

These and other variables are useful when pricing and predicting risks and likely outcomes for a broad population. But individuals require personalized solutions.

Financial planners generally advise that households need approximately 60 percent of previous earning power (i.e., annual net of tax income before inflation) in retirement, yet this assumption doesn’t consider individual factors and can leave older adults financially short.

Let’s review a simple example of how broad assumptions can be so wrong on an individual basis.

A hypothetical 65-year-old couple’s gross income has been $200,000 annually; their net income needed for retirement is assumed to be 60 percent. That means they would need $120,000 in annual cash flow pre-inflation. The lump sum required at retirement would be $120,000 x 15 years = $1.8 million. Assuming an inflation rate of 3 percent, an additional $325,000 would be needed. Our couple might, therefore, assume that the sum they need to retire comfortably is $2.125 million.

But our hypothetical couple may well live beyond the averages. It is a risky strategy to plan only for necessary retirement finances up to an “average” life expectancy. What is their plan if they live longer than the averages and don’t have family or friends to fall back on if they run out of money? At age 65, it is late to create new sources of income if they live longer than expected.

The flaw in the typical financial planning process is simple: underwriting classes used by insurance companies are designed for a large population to minimize risk to the insurance provider. When planning for an individual client, the ranges and averages of the large group can set goalposts but are of little use for individuals interested in bullet-proofing their retirement plans.

Additional facts and risk factors must be considered to provide a meaningful solution for our hypothetical couple, including:

-

What is the couple’s likely life expectancy?

-

What inflation factor should be used in assessing future needs?

-

What cost of living assumptions should be employed?

-

What is an appropriate asset allocation model?

-

What short- and long-term income tax assumptions should we expect for various income streams?

-

What assets should be “tapped” first in creating retirement income?

-

What are the needs of children/grandchildren?

-

Are there large expenses to consider?

Of course, standard of living, lifestyle, travel, housing, and medical expenses are additional factors that vary widely from individual to individual.

This is where a new, large planning opportunity lies. An ideal plan should seek to ensure that our couple will not run out of money, even if one or both spouses live well past average life expectancy.

Imagine a portion of the couple’s net worth, possibly 30 percent of their assets, that could be allocated to fund retirement needs if they “beat the odds” and live well into their 90s. A product that guarantees inflation-adjusted lifelong income is exactly what is needed for today’s retirement realities.

Clearly, there is a need for a product that protects individuals who “beat the odds” and live beyond average life expectancy. Thankfully, a product is in development that seeks to provide both financial security and an inflation hedge to combat the risks of reduced purchasing power. It cannot come too soon. The widespread availability of such a product will allow many more Americans to sleep easier, knowing that they will not outlive their financial resources.

Securities offered through M Holdings Securities, Inc., a registered Broker/Dealer, member FINRA/SIPC. Mullin Barens Sanford Financial & Insurance Services, LLC. is independently owned and operated.